PSERS Special Early Retirement: How You Could Retire Early and Boost Your Pension

Are you thinking about retiring early from PSERS? If so, you are not alone. Many teachers, administrators, coaches, district office staff and Intermediate Unit employees are considering retiring earlier than originally planned. Whatever the motivation, the same big question is usually asked- Can I retire before reaching Normal Retirement and how does it impact my pension?

This article is going to help you understand what Early Retirement means and how you might qualify for PSERS Special Early Retirement. Before we go too much further, let’s review what we mean by Normal Retirement and how to qualify.

How do I qualify for Normal Retirement?

Normal Retirement means that you have achieved certain milestones during your PSERS service which qualify you for a full pension benefit. These milestones are different for the various PSERS members classes.

Class T-C and T-D members can qualify for Normal Retirement by reaching:

- Age 62+ at retirement

- Age 60 at retirement with at least 30 years of credited service

- 35+ years of credited service at retirement

Class T-E and T-F members can qualify for Normal Retirement by reaching:

- Age 65 at retirement with at least three years of credited service

- 35+ years of credited service and any combination of age and years of service that total 92 or more when added together

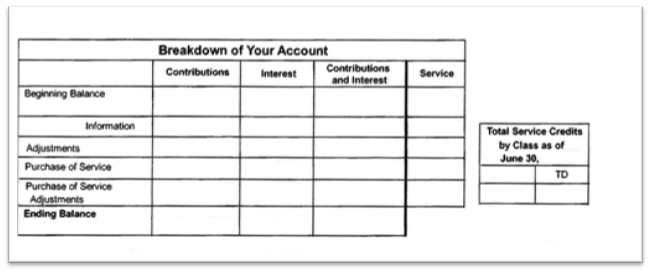

If you have not achieved both the age and years of service milestones for your member class at retirement, you will be retiring “early”. You can find your member class and credited years of service at the top of Page 2 of your PSERS Statement of Account.

If you do not have a recent statement, you can access it by logging into your PSERS Member Self-Service portal here.

If you are thinking about stopping work before reaching Normal Retirement, learn everything you need to know about retiring early here.

How does retiring early impact my pension?

Retiring before reaching Normal Retirement means that your monthly pension will be reduced. The amount that it is reduced depends on how many years away you are from the age and service milestones listed above. In general, the younger you are and fewer years you have of PSERS service, the lower your pension will be at retirement.

When retiring early, your pension will likely be reduced by 4 -7% for each year that you are away from Normal Retirement. For example, a class T-C member who is 58 years old with 28 years of PSERS service would be two years from achieving Normal Retirement. Reaching age 60 with at least 30 years of service is a qualifying milestone for normal retirement.

Another example is a class T-C member who is 60 years old with 25 years of service would have two years yet before reaching Normal Retirement. In two years, they will be 62 which automatically qualifies them if they have one year of service.

No one wants their pension to be lower. Many PSERS members retiring early have worked for 25 years or more and have earned every dollar of their pension. The good news is PSERS created a retirement qualification with these members in mind called Special Early Retirement.

What is PSERS Special Early Retirement?

If you are age 55 or over with at least 25 years of service, you could qualify for PSERS Special Early Retirement. You may find this retirement status referred to as “Special 55/25”.

The main benefit is that your pension is reduced by a lower amount than if you were simply retiring early. If you qualify, your pension will be reduced by 0.25% for each month you have left before reaching normal retirement. This means a 3% pension reduction (0.25% x 12 months) for retiring a full year early which is much better for you than the 4-7% yearly reduction for early retirement.

Let’s explore an example to help illustrate the potential pension benefits of qualifying for Special Early Retirement.

Mary, a class T-C PSERS member, is age 55 and has 25 years of service. To reach Normal Retirement, she must either reach age 62 or age 60 with 30 years of service. She has seven years before reaching age 62 but only five years before achieving age 60 with 30 years of service. If she decided to retire today, she would be considered retiring five years early since she is that many years away from the closest Normal Retirement milestone.

Since she qualifies for Special Early Retirement, her pension will be reduced by 0.25% per month for those five years or a 15% total reduction. Had Mary only qualified for Early Retirement, her benefit would likely have been reduced by around 30%.

PSERS Special Early Retirement can be a happy middle ground

- Is working a few more years really worth it?

- How much will my pension change if I put in a couple more years?

- How much longer should I work so my pension isn’t reduced?

Many soon-to-be PSERS retirees ask themselves these questions as they explore their retirement choices. It can be difficult to make these big decisions when you want as high a pension as possible but also want to retire and move on.

Receiving a full, unreduced pension is the retirement goal of most PSERS members. However, you might have found that the years of service required to reach Normal Retirement is simply not achievable. The Special Early Retirement status was created for people just like you. If you have not yet qualified and are thinking about stopping work soon, you should consider how your pension would be increased by working just long enough to avoid Early Retirement and qualify for PSERS Special Early Retirement status.

PSERS members who retire before age 55 but who have reached 25 years of service will not qualify for Special Early Retirement. However, there is a strategy to consider that could provide a major long-term boost to your pension. Let’s use an example to illustrate this strategy.

John is 54 and retiring from PSERS. He simply doesn’t want to work anymore. He has 25 years of credited service but, because he is only 54, he will be considered retiring early. This means his pension will be reduced. However, there is something that John can do with proper planning. John could retire and elect to defer his pension payments until he reaches age 55. At that time, he will have reached both the age and service milestones needed to qualify for Special Early Retirement. He can then start his pension payments which will be higher for life.

In John’s case, careful planning comes into play so he can supplement his monthly income from the time he retires until he reaches 55 and starts his pension payments. This could mean that he works another job, lives off of other money or reduces his expenses during that time. While this strategy may not be possible for everyone, deferring pension payments until qualifying for PSERS Special Early Retirement should be a consideration by anyone who comes close to the age milestone at retirement.

What should I do next?

If you want to see how working a few more years to qualify for PSERS Special Early Retirement or Normal Retirement benefits you, check out the PSERS benefit calculator. This tool allows you to run retirement scenarios and learn how different retirement ages and years of service change your pension. All you need to get started is your most recent PSERS Statement of Account.